The very thought of investing in non-agency mortgage backed securities still strikes fear in the hearts of many investors. The ones that collapsed are still very much alive though. Mortgage backed securities, or MBS, became a household name during the housing collapse of 2007-2008, and the crash of these securities became blamed for a serious […]

A lot of people use credit cards to earn rewards. As it turns out, a very large number of them don’t quite understand how these rewards work, especially with travel rewards. A great many people don’t take much interest in matters of personal finance, even though the effects of this lack of interest and knowledge […]

Precidian Investments filed an application with the SEC back in 2014 for a type of active ETF that does not require transparency. The SEC likes transparency. They finally gave in. To say that the Securities and Exchange Commission, or SEC, prefers transparency in dealings between fund companies and investors would be an understatement. From the […]

While the stock market marches on, many institutional investors worry that it may be over soon. Using options is one way to contain this risk, but is it a good way to do it? With the S&P up 22% from its recent lows, many investors are happily hanging on to their stock positions. Most investors […]

In the latest poll of American Chief Financial Officers, while the overall pessimism regarding the economy is improving a bit, most still feel that a recession will be coming. When economic growth drops to around 2%, it is natural that a lot of people will be more concerned about things deteriorating further, especially if we […]

There is an old adage among investors that they should “sell in May and go away,” taking the rest of the year off. Does this strategy make sense this year? We can and often do look back at previous market data to seek out opportunities to improve our results. There are many adages that have […]

Some investors are becoming concerned about the fact that while major stock market indices are nearing all-time records, the volume of shares traded is going down. The significance of trading volume is one that a lot of technical analysts struggle to really understand, or at least gain a reasonable understanding of them. There are some […]

Many people think of IPOs as an easy opportunity to make a lot of money. The institutions do get greased, but individuals need to be very careful trading them. Day 1 of Pinterest’s initial public offering at least held its ground during its first day trading its stock publicly, but that’s about all we could […]

While some observers have been recommending going long gold recently, the play was really dependent on its not breaking support. It has, and is now at a crossroads. Gold tends to do pretty well when the economy is slowing down, and this has prompted some analysts to recommend taking long positions in gold, to look […]

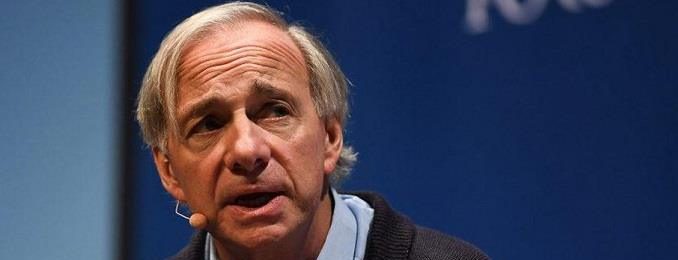

Ray Dalio, the owner of the world’s largest hedge fund, is a capitalist if there ever was one. When he says that capitalism is broken and is in need of a fix, that may say something. Ray Dalio isn’t just an expert on macroeconomics, he made his fortune directly from this knowledge, all $18.4 billion […]