With the Fed still forecasting at least one rate hike in 2019, if not two, and no one really talking much about a rate cut, this does not suggest that things may get unmanageable. One of the questions that people are asking, in the midst of the economic slowdown that we’re seeing, is whether the […]

Many are speculating on the potential effects of a successful trade deal between the U.S. and China, and since this is still weighing us down, there is still upside left with this. There hasn’t been any real doubt that the recent trade tensions between the United States and China have weighed pretty heavily on stock […]

We will be seeing a huge amount of corporate debt maturing soon, with $3.3 trillion of it coming due over the next 5 years. How much should we worry about all of this? Companies obtain financing for their businesses through one of two ways, they can either attract investment through issuing shares or they may […]

It turns out that the Fed being patient with interest rates at this point in time doesn’t mean that all members feel this way. This really shouldn’t matter to us much though. The minutes of the January meeting of the Federal Open Market Committee was released on Wednesday, and it has provided us with a […]

We should always be striving to get the best deal out of our money that we can. Sometimes this involves taking on more risk, but paying off debt is always risk-free. For whatever reasons, many of us approach our savings and our debts separately, and often too separately. There are some situations where we may […]

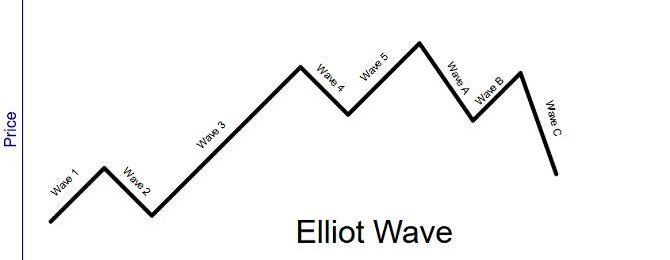

Elliot Wave theory is predicting that the stock market may be in for a pretty big tumble soon. There are several prominent price influencers that also need to be accounted for. Elliott Wave theory is a technique used to predict future prices of securities by applying correlations of up and down patterns to current conditions. […]

President Trump may have helped stock markets overall, and he has been a fairly market friendly president, but his influence here is nowhere near close to what he proclaims. Donald Trump has never been known for his modesty, not when in business, and certainly not as president of the United States. While stock markets have […]

Vanguard started out in 1975 with a novel idea of managing mutual funds. This idea has really caught on over the years and has propelled Vanguard to the top of the heap. The world of mutual funds has historically been a battle between those who can build the best portfolios and outperform the broader market […]

As the reports continue to come in during this earnings season, some of them speak louder than others. This is certainly the case with Walmart’s call scheduled for Tuesday. With the Fed laying off on contracting economic growth, and optimism about getting the U.S. and China trade dispute resolved, investors remain focused on the results […]

$22 Trillion of debt is a huge amount, almost beyond comprehension, but when you add in $70 trillion more, the number gets a lot bigger. It’s also about to grow much bigger. There is already lots of concern about the exploding U.S. national debt, but as it turns out, this is more like the part […]